Startup Accounting Services Dubai: 2026 Guide to VAT & Tax

Essential guide for UAE startups: Learn the costs of accounting services in Dubai, including bookkeeping, VAT registration, and Corporate Tax rules.

Team Timber

•

Tue 03 Feb, 2026

Accounting Services in Dubai for Startups: What You Actually Need

Starting a business in Dubai is exciting; there’s a rush of new opportunities, easy access to global markets, and the economy is booming. But here’s the thing: most startups hit a wall early on because they don’t get their finances right. It sneaks up on you.

One wrong move with your accounting setup, and suddenly you’re facing VAT penalties, corporate tax headaches, cash flow problems, or compliance warnings that can slow you down or even put your business license at risk.

Key Takeaways: Startup Accounting in Dubai

The "Must-Haves" from Day 1: You cannot skip Bookkeeping (to track every transaction) or VAT Monitoring (to know when you hit the mandatory registration threshold). These are non-negotiable for compliance.

What You Can Wait On: Most early-stage startups do not need Full Audits or Complex Financial Advisory immediately. Save your budget until investors or banks specifically request them.

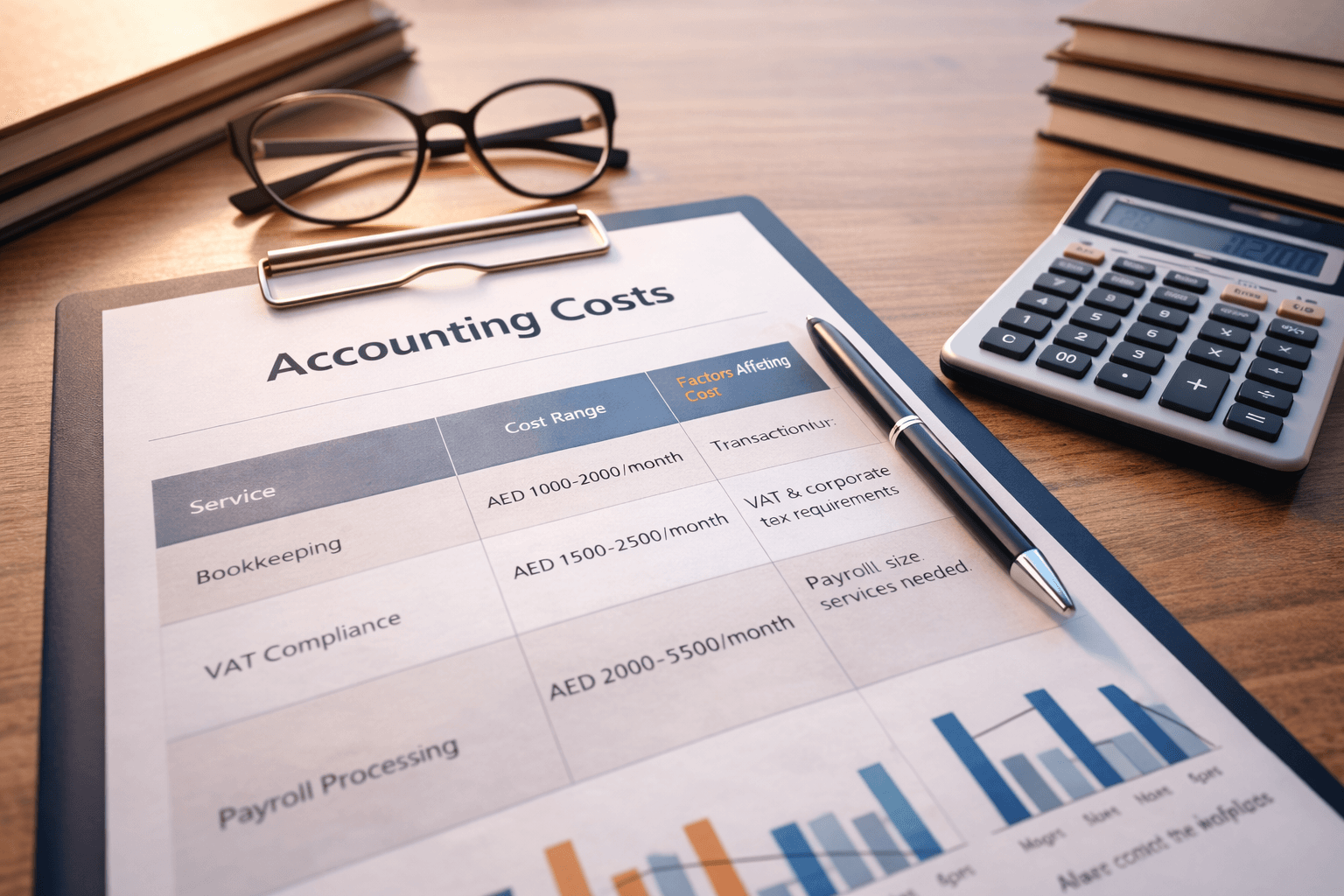

Realistic Costs: Avoid "too good to be true" offers. Expect to pay AED 1,000–2,500/month for professional bookkeeping and AED 2,000–5,500/month for full-service packages (including payroll & VAT).

The "Cheap" Trap: Selecting the cheapest provider often results in sloppy records and missed deadlines, leading to fines that cost far more than professional fees.

Why Timber Accounting: We specialize in startups, offering transparent monthly packages that scale with you—ensuring you stay compliant without overpaying for complexity you don't need yet.

This guide explains exactly which accounting services startups in Dubai actually need, what you can safely skip in the early stage, and how to choose the right accounting firm in Dubai to support long-term growth.

Why Accounting Matters for Startups in Dubai

Dubai’s known for welcoming new businesses, but don’t let that fool you; the financial and tax rules are strict, even for small startups. From day one, the authorities expect you to keep solid accounting records, no matter how small your company is or how much money you’re making.

A lot of founders don’t realize how fast compliance requirements pile up, especially once business starts picking up. Here’s what usually gets overlooked:

Every business needs to keep accurate financial records, invoices, and expense logs that match UAE regulations.

Startups may become liable for VAT registration or corporate tax sooner than expected, and missing deadlines can result in heavy fines.

Certain free zones, banks, and investors require audited or well-prepared financial statements, even in early stages.

Fixing accounting mistakes later is far more expensive and time-consuming than setting things up correctly from the start. Proper accounting gives startups clarity, compliance, and confidence to grow without unexpected financial roadblocks.

What Are Accounting Services in Dubai for Startups?

Accounting services in Dubai for startups cover more than just recording numbers. They ensure your business remains financially compliant, tax-ready, and operationally clear from the very beginning.

For new businesses, these services are designed to reduce risk, maintain transparency, and provide accurate financial insights needed for decision-making and growth.

Below are the core accounting services startups in Dubai typically need.

Bookkeeping & Financial Record Management

Bookkeeping is where it all starts. For startups, it means every transaction is recorded and easy to trace. That covers:

Recording sales, purchases, payments, and receipts accurately to maintain clean financial records.

Monitoring business expenses to control costs, manage budgets, and support tax deductions.

Understanding how money moves in and out of your business to avoid liquidity issues and plan future expenses.

VAT Registration & Filing for Startups

VAT is a major pain point for new businesses in the UAE. You need to know when it kicks in and what to do about it.

Startups must register for VAT once taxable supplies exceed the UAE threshold, or earlier in certain cases.

Errors such as late registration, incorrect VAT calculations, or missing documentation can result in penalties.

VAT returns must be filed on time, and delays or inaccuracies can lead to fines and compliance notices.

Corporate Tax Compliance (UAE)

Corporate tax is here in the UAE, and startups need to know how it affects them.

Determining whether your startup falls under corporate tax requirements based on revenue, activity, and structure.

Tax planning focuses on structuring finances efficiently, while tax filing ensures legal compliance with authorities.

Maintaining proper financial records, profit calculations, and supporting documents for corporate tax submissions.

Payroll & Employee Compliance

Once you start hiring, you’ve got more rules to follow in Dubai. Accounting services usually help with:

Make sure you’re paying salaries through the Wage Protection System, as UAE law requires

Get wages, deductions, and allowances right.

Calculate and plan for gratuity and other required employee benefits.

Payroll mistakes can land you in legal trouble, upset your team, and trigger penalties, so get professional help and save yourself the stress.

Accounting Services Startups Actually Need (And What They Don’t)

One of the biggest mistakes startups make is overpaying for accounting services they don’t yet need. In the early stages, the goal isn’t complexity, it’s compliance, clarity, and control.

Knowing what to prioritize (and what can wait) helps startups manage costs while staying fully compliant with UAE regulations.

Startup Stage | Key Accounting Needs | Why It Matters |

Newly Registered | Bookkeeping setup, compliance planning | Prevents early mistakes and missing records |

Early Operations | Monthly bookkeeping, VAT monitoring | Ensures readiness for VAT and tax filings |

Growing Revenue | VAT filing, payroll compliance | Avoids penalties and employee-related risks |

Scaling Phase | Financial reporting, tax planning | Supports growth and investor discussions |

Must-Have Accounting Services for New Startups

Here’s the bare minimum every Dubai startup should have from day one:

Bookkeeping

Solid bookkeeping keeps your financial records accurate and organized. It’s not just for show — you’ll need this to:

Stay on the right side of the law

Track every dirham coming in and going out

Be ready for VAT and corporate tax filings

In our experience at Timber Accounting, startups that maintain clean bookkeeping from the first month avoid most VAT and tax-related issues later on.

VAT Support

Even if you’re not VAT-registered yet, you’ve got to think about VAT early. VAT support usually covers:

Watching your turnover so you register at the right time

Applying the right VAT treatment to invoices and expenses

Timely VAT return preparation and filing

Basic Financial Reporting

You don’t need fancy dashboards right now, just clear, simple reports. The essentials are:

Profit and loss statements

Cash flow summaries

Services You Can Delay in Early Stages

Not every accounting service is necessary during the startup phase. Some can be introduced later as the business grows.

Full Audits (In Some Cases)

Most startups don’t need a full audit right away; it depends on your business activity, whether you’re in a free zone or on the mainland, and what banks or investors want. Unless someone demands it, focus on keeping your records tidy and audit-ready.

Complex Financial Advisory

You don’t need high-level advice about restructuring, mergers, or deep tax strategies at this stage. Those only come into play when your revenue jumps, you expand into new regions, or you bring in outside investors. Skip these for now and save your budget.

Service | Required at Startup Stage? | Notes |

Bookkeeping | ✅ Yes | Foundation for all compliance |

VAT Monitoring | ✅ Yes | Even before registration |

VAT Filing | ⚠️ Depends | Required once registered |

Payroll & WPS | ⚠️ Depends | Required when hiring staff |

Full Audit | ❌ Not Always | Depends |

Complex Advisory | ❌ Later Stage | Useful when scaling |

Why This Approach Works for Startups

When you cover the basics first, you:

Stay compliant with UAE rules

Cut out extra accounting costs

Scale up your services as your business grows

How Much Do Accounting Services Cost for Startups in Dubai?

There’s no universal price tag. Costs depend on your business size, what you do, and what the law requires. Chasing the cheapest deal isn’t always the smartest move; it’s better to understand what actually drives the price. For startups, think of accounting as a regular monthly expense, not a one-off job.

Common Pricing Models for Startup Accounting

Most accounting firms in Dubai use one of the following pricing structures:

Monthly accounting packages

A fixed monthly fee covering bookkeeping, VAT support, basic reporting, and compliance monitoring. This is the most common and startup-friendly option.

Per-service pricing

Charges are applied separately for services such as VAT registration, VAT filing, payroll, or corporate tax submissions.

Transaction-based pricing

Costs are calculated based on the number of monthly transactions, which works well for startups with predictable volumes.

Factors That Affect Accounting Costs for Startups

Several factors influence how much a startup pays for accounting services in Dubai:

Business activity

Certain activities require additional compliance or reporting, increasing accounting complexity.

Transaction volume

Higher sales, expenses, or bank transactions require more bookkeeping work.

VAT & corporate tax requirements

VAT-registered startups or those subject to corporate tax need additional filings and documentation.

Payroll size

The number of employees affects payroll processing and WPS compliance costs.

Free zone vs mainland setup

Compliance and reporting requirements can differ based on jurisdiction. Understanding these factors helps startups choose a package that fits their current stage without overpaying.

Why Cheap Accounting Usually Backfires

It’s tempting to grab the cheapest accounting services you can find. But low prices often come with problems: sloppy bookkeeping, missed VAT deadlines, weak reports, and trouble when it’s time for an audit or a bank review.

Fixing these issues later usually costs significantly more than setting things up correctly from the beginning.

Reliable accounting services focus on accuracy, compliance, and continuity, not just low pricing.

How to Choose the Right Accounting Firm in Dubai for Startups

Choosing an accounting firm in Dubai isn’t just about chasing the biggest brand or snagging the cheapest deal. For startups, it’s about finding someone who really gets what it’s like at the beginning, someone who understands tight cash flow, the mess of early-stage decisions, and all the UAE’s compliance rules.

Experience With Startups Matters

Most accounting firms are built for big, established businesses. They can end up making things more complicated or expensive than they need to be. You want a firm that’s used to working with startups.

They should get how cash flow works when you’re just starting out, offer flexible service packages that don’t box you in, and give you real-world advice rather than just sending reports. Firms with real startup experience know what to focus on and don’t bury you in unnecessary details.

Strong Knowledge of UAE Regulations

Accounting in Dubai is tied closely to local laws. Your firm needs to be on top of VAT, corporate tax, all those free zone vs mainland rules, and the documentation you’re supposed to keep.

If they aren’t, you risk fines, license headaches, or banking delays. Local expertise isn’t optional; it’s essential.

Transparency in Pricing and Scope

Avoid any firm that’s sketchy about what you’re actually paying for. A good firm lays out exactly what’s included each month, what costs extra, and how fees change as you grow. This way, you can plan ahead and avoid getting hit with surprise bills.

Scalability and Long-Term Support

Your accounting needs will change fast. The right firm can grow with you, whether it’s more reporting when revenue jumps, help during audits or fundraising, or advice as tax rules shift. Switching accountants later is a pain, so pick someone who can stick with you for the long haul.

Communication and Accessibility

Startups need quick answers, especially when dealing with compliance deadlines.

Before you choose a firm, see how easy they are to reach, how quickly they respond, and if you’ll have a go-to person. Good communication keeps stress down and lets you stay focused on building your business.

FAQs – Accounting Services in Dubai for Startups

Do startups need an accountant immediately after company registration?

Not immediately, but startups do need proper accounting from the first financial transaction. Delaying setup often leads to missing records, VAT issues, and inaccurate financial reporting that becomes costly to fix later.

When should a startup register for VAT in Dubai?

A startup must register for VAT once taxable supplies reach the mandatory threshold. However, early monitoring is critical, as late registration can result in backdated VAT liabilities and penalties.

What accounting records must startups legally maintain in the UAE?

Startups must maintain:

Sales and purchase invoices

Expense records

Bank statements

VAT documentation (if applicable)

These records must be accurate, organized, and available for review when required by authorities.

Is outsourcing accounting safe for startups in Dubai?

Yes. Outsourcing is common and safe when handled by a UAE-experienced accounting firm that understands VAT, corporate tax, and local compliance requirements.

How often should startups review their financial reports?

At a minimum, startups should review financial reports monthly. Regular reviews help founders control cash flow, track expenses, and avoid compliance surprises.

What makes Timber Accounting suitable for startups?

Timber Accounting focuses on startup and SME accounting, offering structured compliance, clear reporting, and scalable services without unnecessary complexity. Our approach prioritizes accuracy, transparency, and long-term stability.

Final Thoughts: Set Your Startup Up for Financial Success

Accounting is not just a regulatory requirement; it’s a foundation for sustainable growth. For startups in Dubai, getting accounting right from the beginning reduces risk, protects cash flow, and builds long-term credibility.

Focusing on the right services, choosing the right accounting partner, and avoiding common mistakes allows founders to concentrate on what matters most: growing the business.

Starting a business in Dubai or planning to scale?

Book a free startup accounting consultation with Timber Accounting to understand your VAT, tax, and bookkeeping requirements before small mistakes turn into costly problems.

Simplifying accounting and tax filing for businesses

An AI-powered finance solution, supported by real accountants, to simplify your finances without the high costs or complexity of traditional accounting services.