10 Essential Bookkeeping Tips for Dubai SMEs (VAT & Corporate Tax 2026)

Learn how Dubai small businesses can stay VAT-compliant and corporate tax-ready in 2026 with practical bookkeeping tips built for UAE regulations.

Team Timber

•

Wed 28 Jan, 2026

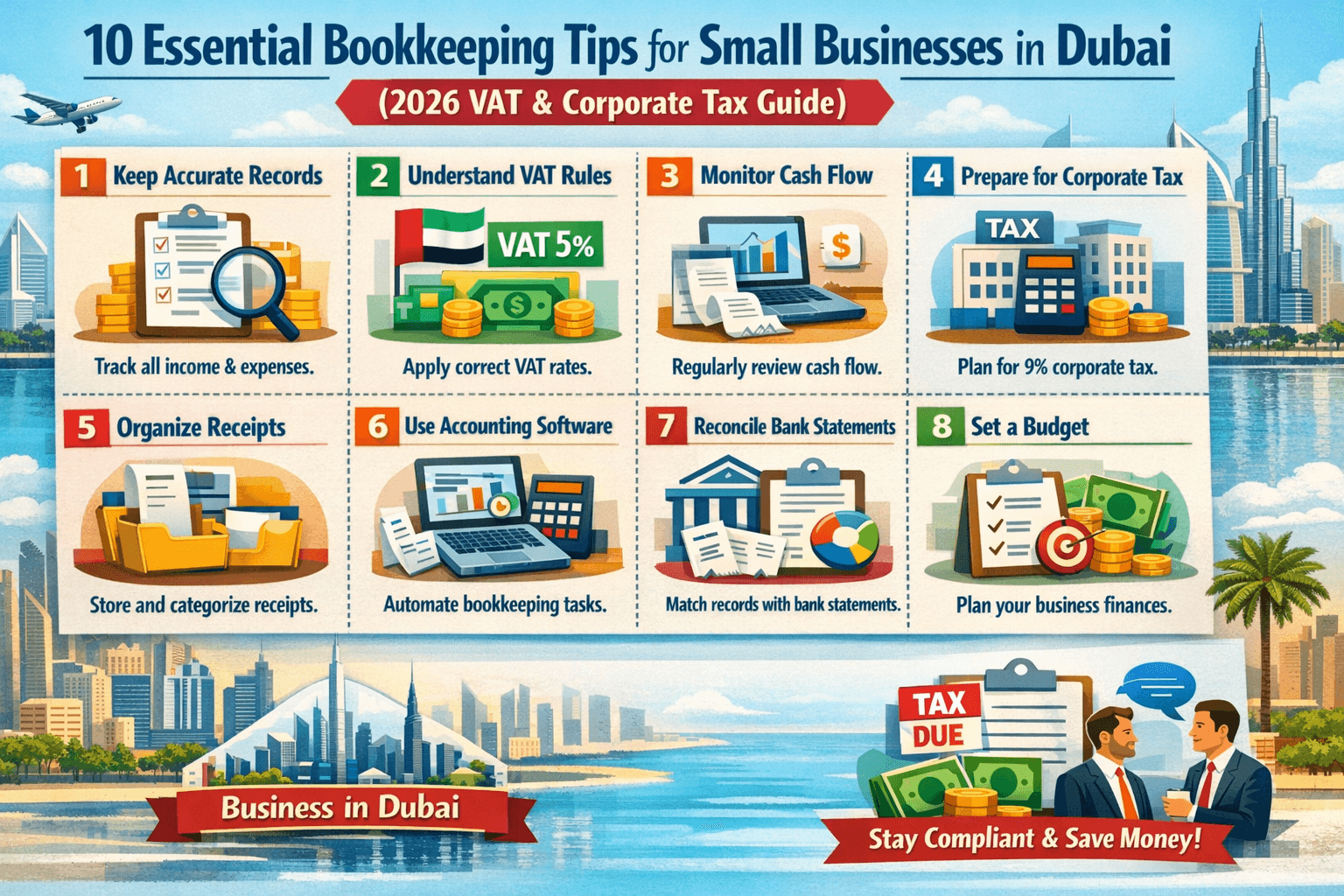

10 Essential Bookkeeping Tips for Small Businesses in Dubai (2026 VAT & Corporate Tax Guide)

Running a small business in Dubai comes with speed, ambition, and opportunity. But behind every successful UAE business is something far less glamorous — accurate, compliant bookkeeping.

In Dubai, bookkeeping isn’t just about tracking income and expenses. It directly affects your:

VAT compliance

UAE corporate tax filings

Audit readiness

Bank approvals

Business license renewals

Even small bookkeeping errors can lead to penalties, rejected VAT returns, or regulatory scrutiny from the FTA.

As compliance requirements grow more complex, many Dubai SMEs are moving away from manual systems and adopting cloud-based and AI-supported bookkeeping models. This guide explains 10 essential bookkeeping best practices, specifically tailored to Dubai and the wider UAE regulatory environment.

Why Proper Bookkeeping Is Critical for Small Businesses in Dubai

VAT & Corporate Tax Compliance

In Dubai, bookkeeping is directly tied to regulatory compliance. Businesses must maintain accurate financial records to meet VAT reporting requirements, comply with the 9% UAE corporate tax, follow payroll and WPS regulations, and address Economic Substance Regulations where applicable. Clean, up-to-date books reduce the risk of penalties, audits, and filing delays with the Federal Tax Authority.

Financial Transparency for Banks, Investors, and Partners

Banks, investors, and commercial partners expect clear, professionally prepared financial statements. Whether applying for financing, raising capital, or extending supplier credit, transparent records are essential. Incomplete or inconsistent bookkeeping often results in rejected applications and lost opportunities.

Higher Standards Through Automation

The expectations around bookkeeping have changed. Modern businesses rely on automated systems to handle expense tracking, VAT categorization, invoicing, bank reconciliation, and tax calculations. Manual bookkeeping increases the risk of errors and makes it difficult to scale while staying compliant.

Accurate Data Enables Confident Decision-Making

Timely and reliable financial data allows business owners to understand cash flow, assess profitability, manage receivables, and plan future expenses effectively. In a fast-moving market like Dubai, decisions based on outdated or inaccurate data can quickly impact growth and financial stability.

10 Bookkeeping Best Practices Every Dubai SME Should Follow

1. Separate Personal and Business Finances

Mixing personal and business expenses is one of the most common compliance issues in the UAE.

Best practice:

Open a dedicated business bank account

Use separate cards for business expenses

Connect your bank account to accounting software for automatic imports

This alone reduces reconciliation errors and audit risk significantly.

2. Track Every Expense With Proper Documentation

Dubai’s regulatory environment is documentation-heavy.

Every expense should be:

Recorded

Categorized

Assigned the correct VAT treatment (standard, zero-rated, exempt)

Backed by a receipt or invoice

Digital receipt capture and OCR tools make this process faster and more accurate.

3. Use VAT-Compliant Automated Invoicing

Late payments hurt cash flow, especially for SMEs.

Your invoicing system should support:

Automated payment reminders

Online payment options

VAT-compliant invoice formats

Overdue tracking

Recurring invoices for retainers or subscriptions

Advanced systems can even optimize reminder timing based on payment behaviour.

4. Reconcile Bank Accounts Regularly

Bank reconciliation ensures your books match real-world transactions.

Why this matters in Dubai:

VAT filings rely on accurate figures

Banks may conduct compliance checks

Auditors require matching records

Monthly reconciliation is the minimum. Weekly is ideal for growing businesses.

5. Use Cloud-Based Accounting Software

Cloud accounting is no longer optional for UAE businesses.

A modern system should offer:

Real-time access

Secure backups

Multi-device support

Collaboration with accountants

Automated transaction syncing

Popular platforms include Xero, QuickBooks, and Zoho Books, which form the foundation of many UAE accounting setups.

6. Maintain Payroll According to UAE Labour Law

Payroll errors can create legal and financial risks.

You must:

Record overtime correctly

Track leave balances

Calculate End of Service Benefits (EOSB)

Maintain employee contracts and deductions

Automated payroll systems reduce calculation errors and compliance gaps.

7. Stay Updated on VAT and Corporate Tax Changes

UAE tax regulations continue to evolve.

Businesses must stay aligned with:

Corporate tax thresholds and exemptions

VAT filing cycles

Updated FTA guidelines

Industry-specific tax treatments

Automated systems help track updates and adjust calculations in real time.

8. Store Digital Copies of All Financial Documents

The FTA may request records going back:

2 years

5 years

Up to 7 years for certain sectors

Digital document storage ensures fast retrieval and audit readiness.

9. Forecast Major Expenses and Renewals

Dubai businesses face predictable but significant expenses:

Trade license renewals

Office rent

Visa renewals

Insurance

Equipment upgrades

Marketing campaigns

Cash flow forecasting helps you plan these expenses without financial strain.

10. Work With Dubai Accounting Specialists

Even with powerful software, local expertise matters.

Dubai accounting specialists understand:

VAT filing and documentation

Corporate tax compliance

Free Zone vs Mainland rules

Payroll and WPS

FTA audits and reporting standards

This is not an area for trial and error. One missed deadline can cause penalties or licensing delays.

Modern Bookkeeping in Dubai: Why Hybrid Models Work Best

Traditional bookkeeping alone is slow.

AI-only tools lack regulatory judgement.

The most effective approach for Dubai SMEs is a hybrid model:

AI for automation, speed, and accuracy

Human accountants for review, compliance, and oversight

This model ensures:

Faster processing

Fewer errors

Audit-ready records

Full UAE compliance

Why Many Dubai SMEs Choose Timber

Timber is built around this hybrid approach — combining AI-powered automation with real human accountants who understand UAE regulations.

Timber works alongside existing platforms like:

QuickBooks

Xero

Zoho Books

Wafeq

Peko

Rather than replacing your tools, Timber acts as an intelligent compliance and accuracy layer on top.

Key advantages include:

Real-time bookkeeping

AI-assisted categorization

Human review for VAT and corporate tax

Secure document storage

Voice-based expense and invoice entry for busy founders

Frequently Asked Questions (Dubai Bookkeeping, VAT & Corporate Tax)

1. Is bookkeeping legally required for small businesses in Dubai?

Yes. Every licensed business in Dubai and the UAE is required to maintain proper financial records. This applies whether or not the business is VAT registered. Accurate bookkeeping is essential for VAT compliance, corporate tax filings, audits, bank reviews, and trade license renewals.

2. How long should businesses keep bookkeeping records in the UAE?

Most businesses must retain financial records for at least 5 years, while certain sectors may be required to keep records for up to 7 years. These records must be accessible and verifiable if requested by the Federal Tax Authority or other regulators.

3. What bookkeeping records are critical for VAT compliance?

For VAT purposes, businesses should maintain:

VAT-compliant tax invoices

Expense receipts with correct VAT treatment

VAT return calculations and summaries

Bank reconciliation records

Documentation supporting zero-rated or exempt supplies

Well-maintained records reduce filing errors and lower the risk of penalties or audits.

4. How does bookkeeping affect UAE corporate tax?

Corporate tax is calculated directly from your accounting records. Inaccurate or incomplete bookkeeping can result in incorrect taxable profit, missed deductions, delayed filings, or increased audit exposure under the UAE’s corporate tax framework.

5. Can small businesses manage bookkeeping using Excel or manual methods?

While manual bookkeeping is still possible, it carries higher risks. As compliance requirements grow, most Dubai SMEs now rely on cloud-based accounting systems to improve accuracy, ensure audit readiness, and maintain real-time financial visibility.

6. What accounting software is commonly used by Dubai SMEs?

Many UAE businesses use platforms such as QuickBooks, Xero, or Zoho Books. These systems support VAT-compliant invoicing, automated reconciliation, and structured financial reporting when configured correctly.

7. How often should bank accounts be reconciled?

Monthly reconciliation is the minimum standard. Businesses with frequent transactions or tighter cash flow cycles often reconcile weekly to maintain accuracy and stay compliant.

8. Do Free Zone companies need the same level of bookkeeping?

Yes. Free Zone status does not remove bookkeeping obligations. Depending on the business activity, Free Zone companies may still be subject to VAT, corporate tax considerations, audits, and regulatory reporting requirements.

9. What happens if records are incomplete during an FTA review or audit?

Incomplete records can lead to penalties, delayed assessments, or follow-up reviews. Clear, well-organized bookkeeping significantly reduces audit stress and helps resolve regulatory queries faster.

10. Why do many Dubai SMEs choose a hybrid bookkeeping model?

Purely manual systems are slow, while software alone lacks regulatory judgement. Many businesses adopt a hybrid approach — combining automation for efficiency with experienced accountants for review, compliance, and oversight — to stay accurate, compliant, and scalable.

Final Thoughts: Build a Future-Proof Bookkeeping System

Dubai rewards businesses that are:

Organized

Compliant

Scalable

Bookkeeping is no longer just about avoiding penalties. It’s about building a business that can grow confidently, attract funding, and operate without financial stress.

By following these bookkeeping best practices and using a blend of automation and expert oversight, your business can:

Stay compliant

Save time

Reduce costs

Improve profitability

Make smarter decisions

👉 Looking for accurate, AI-powered, and fully Dubai-compliant bookkeeping? Let expert accountants and intelligent automation handle your books, so you can focus on growth.

👉 Book your free consultation today: https://timber.me

Read More ways of bookingkeeping in right way .

Understand Cost Effectiveness of Timber Accounting Service For bookkeeping and other accounts service.

Simplifying accounting and tax filing for businesses

An AI-powered finance solution, supported by real accountants, to simplify your finances without the high costs or complexity of traditional accounting services.