Cost-Effective Accounting And Bookkeeping Strategies for Startups

This article outlines practical, cost-effective approaches to accounting and bookkeeping that will help your startup maintain compliance, preserve cash flow, and build investor confidence—all while keeping costs manageable.

Team Timber

•

Mon 12 May, 2025

Starting a business in the UAE and broader GCC region presents unique financial challenges that can overwhelm new entrepreneurs. From navigating complex regulatory requirements to managing limited resources, startups face significant hurdles in establishing proper financial systems. Yet, implementing sound accounting and bookkeeping practices from day one isn't just about compliance—it's a critical foundation for sustainable growth.

Many startups in Dubai and across the UAE operate with tight budgets and limited financial expertise. Founders often wear multiple hats, including that of accountant, which can lead to costly mistakes. The region's rapidly evolving regulatory landscape—including VAT implementation, Economic Substance Regulations, and increasing compliance requirements—makes professional financial management even more essential.

The good news is that with the right strategies, startups can establish efficient accounting systems without breaking the bank. This article outlines practical, cost-effective approaches to accounting and bookkeeping that will help your startup maintain compliance, preserve cash flow, and build investor confidence—all while keeping costs manageable.

Understanding Regional Regulatory Requirements

The UAE and broader GCC region operate under specific financial regulations that directly impact startups. Understanding these requirements is the first step in developing cost-effective accounting strategies.

For startups in the UAE, financial compliance begins with understanding which regulations apply based on your company structure and location. Mainland companies, free zone entities, and offshore companies each face different accounting obligations. For instance, free zone companies may enjoy certain tax exemptions but still must maintain proper accounting records and, in many cases, submit audited financial statements annually.

Common compliance pitfalls for startups include:

Failing to maintain proper accounting records from the beginning, leading to costly reconstruction later

Misunderstanding VAT obligations, especially regarding registration thresholds and filing requirements

Overlooking Economic Substance Regulations, which require certain entities to demonstrate adequate economic activity

Not preparing for mandatory audit requirements, which apply to many UAE companies regardless of size

The cost implications of non-compliance can be severe. VAT penalties, for example, can reach up to 50,000 AED for failing to keep required records. Late registration penalties accumulate at 20,000 AED, while filing errors can cost 5,000 AED per mistake. Beyond direct financial penalties, compliance issues can damage your relationship with banks, limit access to financing, and create obstacles to future growth.

By building compliance into your accounting systems from the start, you avoid these costly penalties and the expense of retroactively correcting mistakes—a process that typically costs 3-5 times more than getting it right the first time.

Cloud-Based Accounting Solutions

Cloud-based accounting platforms have revolutionized financial management for startups, offering sophisticated capabilities at a fraction of the cost of traditional systems.

When comparing traditional vs. cloud-based accounting systems, the cost difference is striking. Traditional accounting software typically requires:

Upfront license fees of 5,000-15,000 AED

Annual maintenance costs of 10-15% of the license fee

IT infrastructure expenses including servers and maintenance

IT support personnel

Manual updates and backups

In contrast, cloud-based solutions operate on subscription models, with costs for startups typically ranging from 200-500 AED monthly. These solutions eliminate infrastructure costs, automatically handle updates and backups, and scale easily with your business.

For UAE startups, the ideal accounting software should include:

VAT compliance features specific to UAE regulations

Multi-currency functionality for international transactions

Bank feed integration with local UAE banks

Arabic language support for bilingual reporting

Role-based access controls for team collaboration

Mobile accessibility for on-the-go management

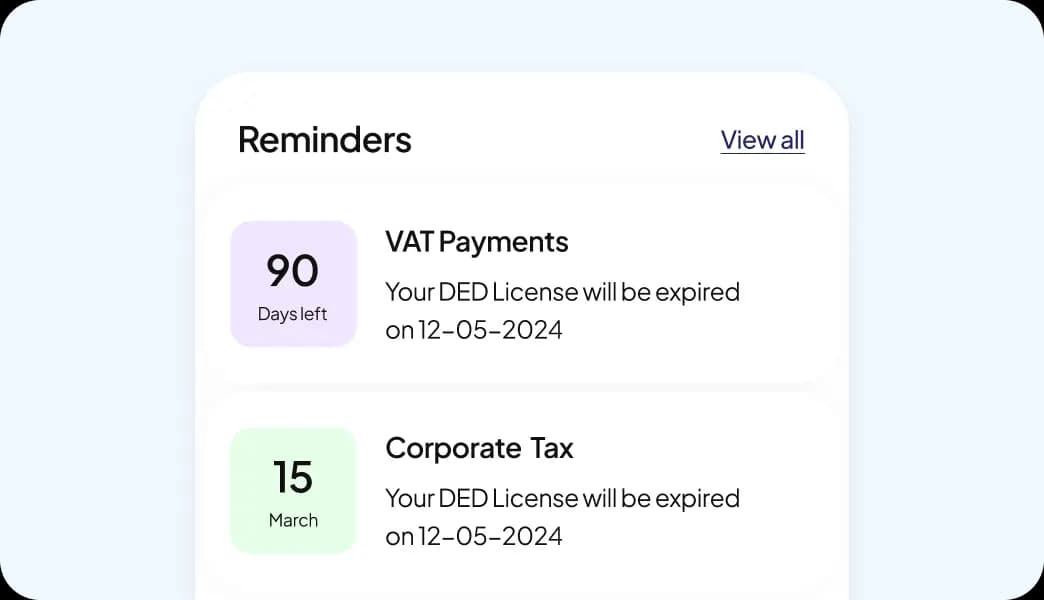

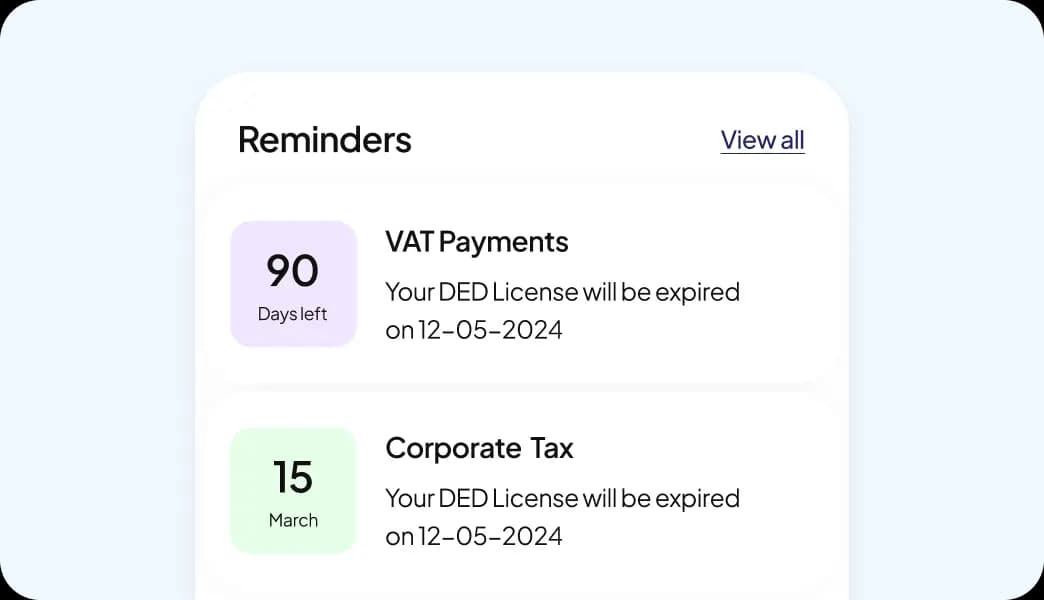

Popular cloud-based options include Xero, QuickBooks Online, and Zoho Books, all of which offer UAE-specific versions with VAT compliance features. Many of these platforms integrate with other business tools, further streamlining operations and reducing costs.

The return on investment from cloud accounting solutions is substantial—startups typically report 15-20 hours saved per month on manual bookkeeping tasks, allowing founders to focus on growth rather than administrative work.

Strategic Outsourcing vs. In-House Teams

One of the most significant financial decisions for UAE startups is whether to build an in-house accounting team or outsource to professionals.

For early-stage startups, hiring a full-time accountant rarely makes financial sense. The average salary for a qualified accountant in Dubai ranges from 15,000-25,000 AED monthly, plus benefits, workspace costs, and training expenses. This translates to an annual investment of 200,000-350,000 AED—a substantial commitment for a new business.

Outsourcing, by comparison, offers flexible, scalable solutions that grow with your business. Bookkeeping services in Dubai typically offer tiered packages starting from 1,500-3,000 AED monthly for basic services, scaling up as your needs increase. This approach allows startups to access professional expertise without the overhead costs of an in-house team.

The optimal approach often changes as startups mature:

Pre-revenue stage: Utilize founder knowledge supplemented by basic bookkeeping services and accounting software. Cost: 1,500-3,000 AED monthly.

Early revenue stage: Outsource regular bookkeeping and compliance work while maintaining strategic financial oversight in-house. Cost: 3,000-6,000 AED monthly.

Growth stage: Consider a hybrid model with an in-house financial controller supported by outsourced specialized services like tax planning and audit preparation. Cost: 10,000-15,000 AED monthly.

Scale-up stage: Build a core finance team while maintaining relationships with external specialists for advanced needs. Cost: Varies based on company size and complexity.

Timber offers flexible accounting solutions that adapt to each stage of startup growth, providing the right level of support without unnecessary costs. This adaptability is particularly valuable in the UAE market, where regulatory requirements can change as your business expands.

Cash Flow Management Techniques

For startups, maintaining positive cash flow is often more critical than profitability, especially in the early stages. Effective cash flow management preserves runway and helps avoid costly emergency financing.

Practical strategies for maintaining healthy cash flow include:

Invoice management automation: Implement systems that automatically send invoices, follow up on payments, and track receivables. This can reduce average collection time by 10-15 days, significantly improving cash position.

Milestone-based billing: Structure contracts with upfront deposits and milestone payments rather than back-loaded payment terms. This approach ensures regular cash inflows throughout project lifecycles.

Expense monitoring: Use expense management apps that integrate with your accounting software to track spending in real-time, helping prevent budget overruns.

Supplier payment optimization: Negotiate favorable payment terms with suppliers and schedule payments to optimize cash retention while maintaining good relationships.

For cash flow forecasting, startups should implement:

13-week rolling cash flow projections updated weekly

Scenario planning for best-case, expected-case, and worst-case outcomes

Cash flow dashboards that provide visual alerts for potential shortfalls

Common cash flow mistakes among UAE startups include underestimating the time to secure payments (which can be longer in the GCC region), failing to account for seasonal business fluctuations (particularly around Ramadan and summer months), and not maintaining adequate reserves for tax obligations.

By implementing robust cash flow management systems early, startups can extend their runway by an average of 20-30%, potentially the difference between success and failure in challenging markets.

Tax Planning and Optimization

The UAE and GCC region's tax environment has evolved significantly in recent years, making strategic tax planning increasingly important for startups.

The introduction of VAT (Value Added Tax) at 5% in the UAE created new compliance requirements and potential financial implications. Startups need to understand:

VAT registration thresholds (mandatory at 375,000 AED annual turnover, voluntary at 187,500 AED)

Input and output tax mechanisms

Record-keeping requirements (5-year retention period)

Filing deadlines and payment procedures

Free zones continue to offer significant tax advantages, including:

Corporate tax exemptions (though this landscape is changing with recent UAE corporate tax announcements)

Customs duty exemptions

Full repatriation of capital and profits

No currency restrictions

Each free zone has specific requirements, so selecting the right jurisdiction for your business model can yield substantial tax savings. For example, a technology startup might benefit from Dubai Internet City's incentives, while a trading company might find JAFZA's logistics advantages more valuable.

Strategies for tax-efficient operations include:

Structuring supplier relationships to optimize VAT recovery

Timing major purchases to maximize input tax credits

Properly classifying zero-rated and exempt supplies

Planning for the upcoming corporate tax framework

With proper planning, startups can legally reduce their tax burden while maintaining full compliance, preserving precious capital for growth initiatives.

Financial Reporting for Investors

For startups seeking funding, high-quality financial reporting isn't just a compliance exercise—it's a critical tool for attracting investment.

Creating investor-ready financial documents requires:

Consistent application of accounting standards (IFRS preferred by most UAE investors)

Clear segmentation of revenue streams and cost centers

Transparent reconciliation of cash flow to profit/loss

Accurate inventory and asset valuation

Detailed explanations of significant variances

Key financial KPIs that matter to startup investors include:

Burn rate and runway calculations

Customer acquisition cost (CAC) and lifetime value (LTV)

Gross margin and contribution margin analysis

Month-over-month growth rates

Unit economics breakdowns

Startups with professional, transparent financial reporting typically raise funds 30-40% faster than those with disorganized or incomplete financial data. In the competitive UAE startup ecosystem, this advantage can be decisive.

Beyond fundraising, robust financial reporting enables better internal decision-making. Clear visibility into unit economics, customer profitability, and operational efficiency empowers founders to allocate resources strategically, further enhancing capital efficiency.

Scaling Your Accounting Processes

As startups grow, their accounting needs evolve. Planning for this evolution prevents costly system overhauls and disruptions.

Signs that your startup is outgrowing its current accounting setup include:

Monthly closing process taking more than 10 business days

Increasing number of manual workarounds and spreadsheets

Difficulty producing specialized reports for different stakeholders

Challenges managing multiple entities or currencies

Audit findings related to internal controls

When these signs appear, it's time to upgrade your financial infrastructure. Cost-effective approaches to scaling include:

Phased implementation: Rather than a complete system overhaul, gradually implement new components while maintaining core operations. This approach spreads costs over time and reduces operational disruption.

Modular expansion: Add specialized modules to your existing system rather than replacing it entirely. For example, a growing startup might add inventory management or project costing modules to a basic accounting platform.

Process optimization before technology: Before investing in new systems, streamline existing processes to ensure you're not simply automating inefficient workflows. This assessment often identifies significant improvements with minimal investment.

Staff training and development: Upgrading the skills of existing team members is typically more cost-effective than hiring new specialists. Targeted training programs can bridge capability gaps while maintaining institutional knowledge.

The most successful scaling strategies balance immediate needs with long-term objectives. An accounting infrastructure that accommodates 3-5 years of projected growth prevents repeated costly transitions while supporting your evolving business model.

Wrapping Up!

Implementing cost-effective accounting and bookkeeping strategies is a critical success factor for startups in the UAE and broader GCC region. By understanding regulatory requirements, leveraging cloud technologies, strategically outsourcing financial functions, managing cash flow proactively, optimizing tax strategies, producing investor-ready reports, and scaling systems thoughtfully, startups can build a strong financial foundation without unnecessary expense.

These approaches not only reduce costs but also create competitive advantages: better decision-making, increased investor confidence, improved regulatory compliance, and more time for founders to focus on growth rather than administrative tasks.

How Timber Helps Startups Implement Cost-Effective Accounting

Timber specializes in providing startups with accounting solutions that grow with your business. Our services combine AI-powered financial technology with expert human oversight to deliver:

Scalable bookkeeping services that adapt to your startup's stage and needs

Cloud-based accounting systems configured for UAE regulatory compliance

Cash flow optimization strategies tailored to your business model

Investor-ready financial reporting that enhances fundraising success

Tax planning that maximizes available incentives and exemptions

Seamless transitions as your financial needs evolve

Whether you're a pre-revenue startup looking for basic compliance support or a scaling business needing sophisticated financial insights, our flexible solutions provide the right level of expertise at the right cost.

Contact Timber today to discover how our accounting services in Dubai can help your startup build a cost-effective financial foundation for sustainable growth.

Simplifying accounting and tax filing for businesses

An AI-powered finance solution, supported by real accountants, to simplify your finances without the high costs or complexity of traditional accounting services.