How to Get a TRN Number in UAE? Registration & Verification

Need a Tax Registration Number (TRN)? Learn the mandatory thresholds, step-by-step registration process on EmaraTax, and how to verify any TRN instantly.

Team Timber

•

Wed 21 Jan, 2026

TRN Number in UAE: The Definitive Guide (Meaning, Check, & Certificate)

By timber accounting Last Updated: January 2026

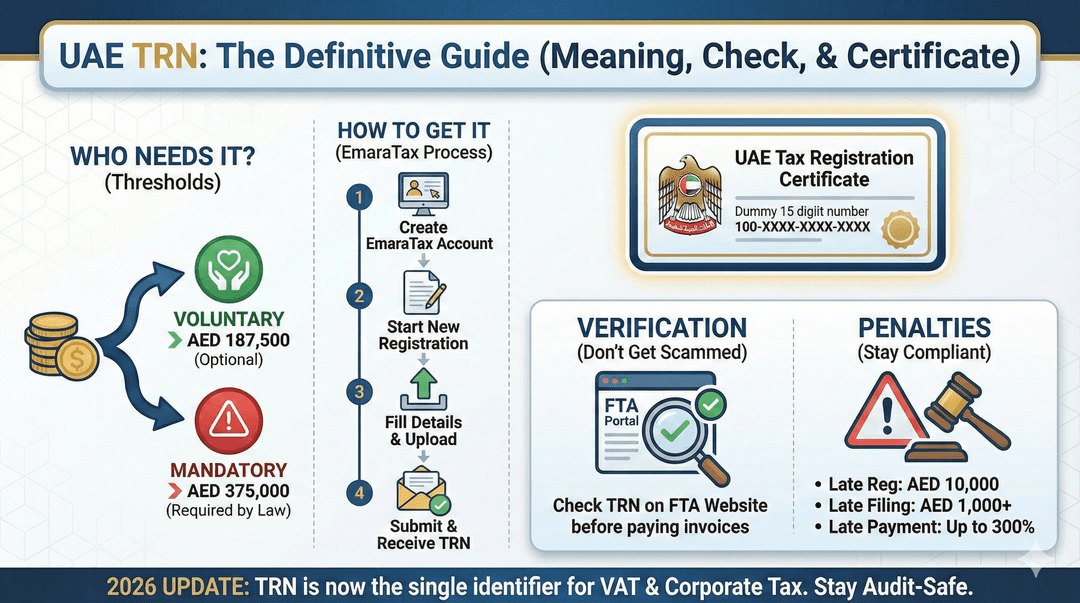

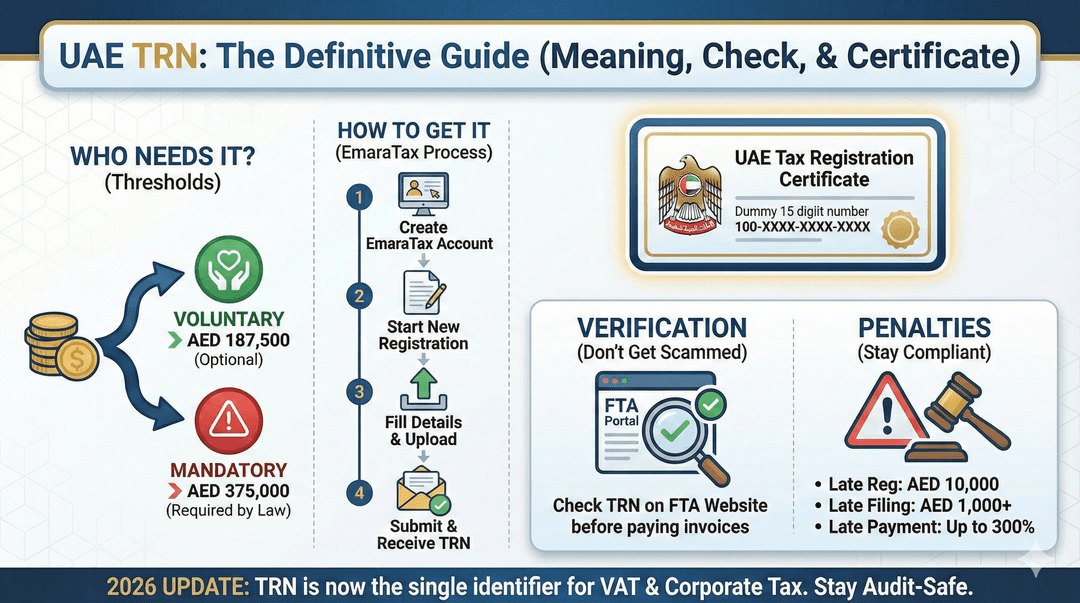

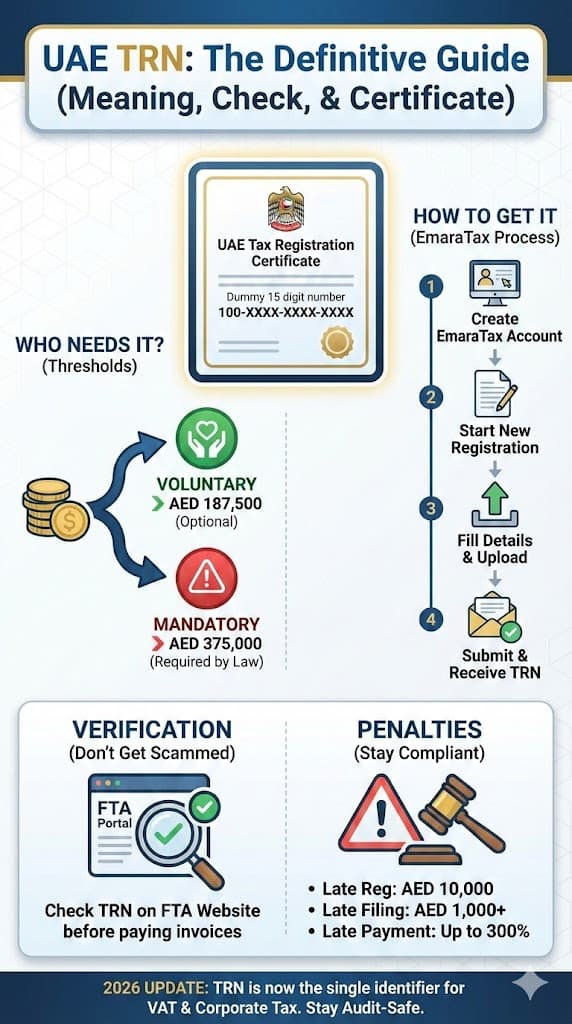

Quick Summary: What You Need to Know

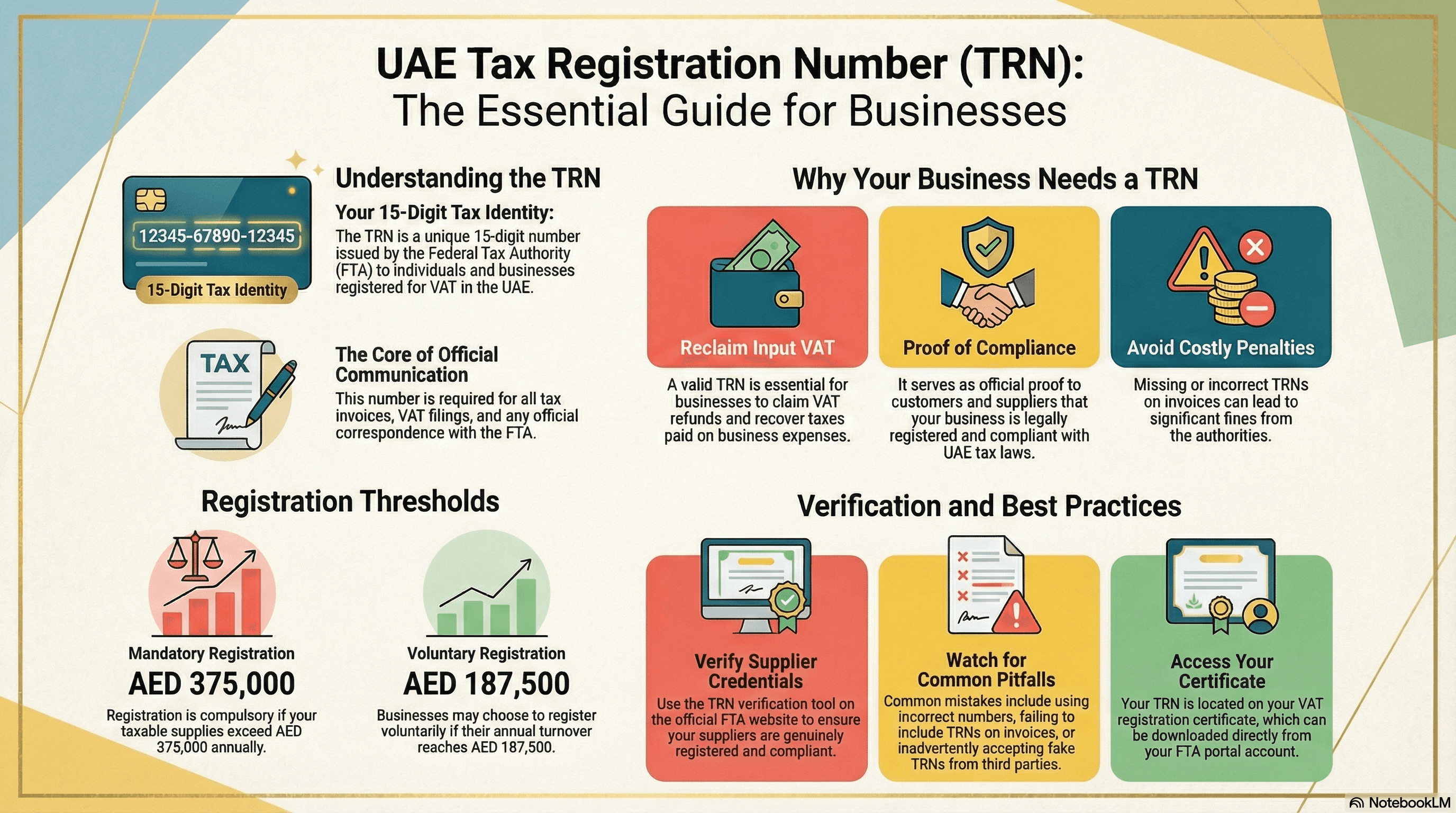

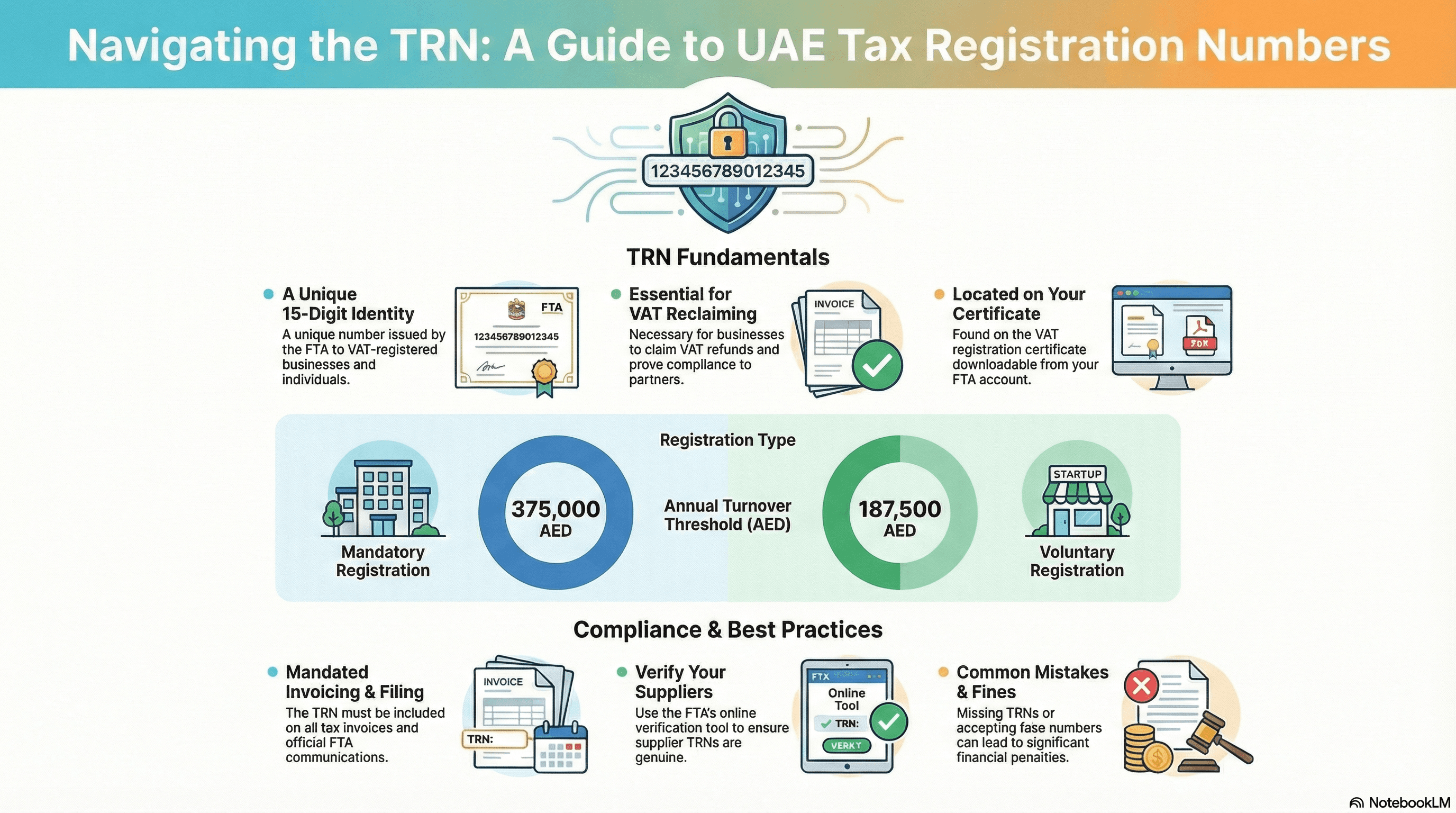

What is it? A 15-digit number issued by the FTA that identifies your business for tax purposes.

Who needs it? Mandatory for businesses with >AED 375,000 turnover. Voluntary for >AED 187,500.

Why care? No TRN = No tax invoices, no input tax recovery, and potential AED 10,000+ fines.

New for 2026: This number is now the backbone for both VAT and the new Corporate Tax compliance.

What Is a TRN Number?

TRN stands for Tax Registration Number.

Think of it as your business’s "tax ID card." It is a unique 15-digit number issued by the Federal Tax Authority (FTA) to businesses (and some individuals) once they register for VAT.

Without this number, your business effectively doesn't exist in the UAE tax system. You cannot legally charge VAT on your invoices, and you certainly cannot claim back any VAT you’ve paid on business expenses.

TRN Full Form & Key Details

Full Form: Tax Registration Number

Issued By: Federal Tax Authority (FTA), UAE

Format: 15 digits (e.g., 100-xxxx-xxxx-xxxx)

Used For:

Issuing legal Tax Invoices

Filing VAT Returns

Customs clearance for imports

Corporate Tax registration (Crucial for 2026)

Who Needs a TRN? (The Thresholds)

Not every business needs to rush to register. The FTA has clear lines in the sand based on your taxable turnover (revenue + imports).

Registration Type | Annual Turnover Threshold | Who is it for? |

Mandatory | Exceeds AED 375,000 | Required by law. You must register within 30 days of crossing this limit. |

Voluntary | Exceeds AED 187,500 | Optional. Great for startups who want to claim back VAT on startup costs. |

Exempt | Below AED 187,500 | Small businesses or freelancers who don't need to worry about VAT yet. |

Pro Tip: The "turnover" includes all your taxable sales and imports. If you ignore this and cross the AED 375k mark, you are instantly liable for late registration fines.

How to Get a TRN Number in UAE (Step-by-Step)

Getting your TRN isn't rocket science, but it does require precision. A single typo in your "Turnover Declaration" can trigger an audit.

The 4-Step Process:

1. Create an EmaraTax Account

Go to the [suspicious link removed].

Sign up using your email or UAE Pass (UAE Pass is faster).

2. Start a New VAT Registration

Once logged in, look for the "VAT" tab and click "Register".

You will be asked if you are registering as a "Legal Person" (Company) or "Natural Person" (Freelancer/Sole Trader).

3. Fill in the Details (The Critical Part)

Entity Details: Trade license number, owner details.

Business Activities: What do you actually do? (Match this to your trade license).

Financials: Upload proof of turnover (invoices, P&L, or a letter signed by your manager).

Bank Details: IBAN where you want refunds sent.

4. Submit & Wait

The FTA typically reviews applications in 20 business days.

Once approved, your TRN is generated instantly.

Need a deep dive? Check out our full guide: [How to Register for VAT in UAE (Screenshots Included)].

What Is a TRN Certificate?

Once you are approved, you get a VAT Registration Certificate. This is the "diploma" you hang on your wall.

What’s on the Certificate?

TRN Number: clearly displayed.

Effective Registration Date: The day you officially became taxable.

Legal Name: Ensure this matches your Trade License exactly.

Rule of Thumb: If you are B2B, your customers will ask for a copy of this certificate before they pay you. Keep a PDF handy.

How to Check & Verify a TRN Number

Received an invoice from a supplier and want to make sure their TRN is real? Fake TRNs are a common way to commit fraud. Always verify before you pay.

The 10-Second Verification Trick:

Go to the FTA TRN Verification Page.

Enter the 15-digit TRN.

Enter the security code (captcha).

Result: If valid, it will show the legal name of the business (e.g., "Timber.me LLC").

If the name doesn't match the invoice? Do not pay.

Penalties: What Happens If You Ignore TRN?

The FTA has a "long memory" and strict fines. In 2026, compliance is tighter than ever.

Late Registration: AED 10,000 (If you cross the AED 375k threshold and don't register within 30 days).

Late Tax Return Filing: AED 1,000 (first time) to AED 2,000 (repeat).

Late Tax Payment: Up to 300% of the unpaid tax amount over time.

Failure to Display Prices with Tax: AED 15,000.

Don't risk it. If you are close to the threshold, get an assessment.

Book A Consultation With Our TAX Expert

Frequently Asked Questions About TRN

Q: Is a TRN the same as a Trade License number?

A: No. Your Trade License permits you to operate in the UAE. Your TRN permits you to collect tax. They are completely separate systems.

Q: Can I use one TRN for multiple branches?

A: Yes! If your branches are under the same legal ownership structure (and trade license), you generally use one single TRN for the whole group.

Q: How much does it cost to get a TRN?

A: The registration application itself on the EmaraTax portal is free. However, if you hire an agency or tax consultant to handle the paperwork for you, they will charge a service fee.

Q: Is TRN required for Corporate Tax?

A: Yes. The same TRN is now used as your identifier for Corporate Tax registration. You do not get a separate "Corporate Tax Number"—your TRN is your universal tax ID.

Q: Can I deregister my TRN if my business closes?

A: Yes, and you must do it within 20 days of closing or stopping taxable sales. Failing to deregister also carries a fine of AED 10,000.

Final Thoughts

TRN isn't just a number; it's your license to do business professionally in the UAE. It keeps you audit-safe, builds trust with clients, and ensures you aren't bleeding money in fines.

Ready to register but afraid of making a mistake?

Don't wing it with the FTA.

Corporate Tax Registration: Let us handle your TRN registration today.

Download the document for a visual walk-through:

What is TRN Number in UAE? | Tax Registration Explained Simply.

Read Other Blogs Related To Corporate Tax Registration How to and deadlines by UAE government 2026:

Simplifying accounting and tax filing for businesses

An AI-powered finance solution, supported by real accountants, to simplify your finances without the high costs or complexity of traditional accounting services.