AI Accounting & Online Accounting in UAE: The 2026 Practical Guide for SMEs

Discover how AI accounting and online accounting help UAE SMEs improve VAT accuracy, corporate tax compliance, and real-time financial visibility in 2026.

Team Timber

•

Fri 02 Jan, 2026

As 2026 begins, accounting for UAE businesses is no longer just about keeping books balanced. With VAT enforcement becoming stricter, corporate tax firmly in place, and sustainability reporting gaining momentum, traditional accounting methods are struggling to keep up.

Many SMEs across Dubai, Abu Dhabi, and the wider UAE are now asking the same question: How can we stay compliant, efficient, and future-ready without increasing overheads?

This is where AI accounting and online accounting come into focus.

By the end of this guide, you’ll understand how AI-powered and cloud-based accounting works in the UAE, when it makes sense to adopt it, and how to use it responsibly without compromising compliance or trust.

Why Traditional Accounting Is Failing Growing UAE SMEs

For many years, spreadsheets and basic bookkeeping software were sufficient for small businesses in the UAE. They offered a low-cost way to track income and expenses and met compliance needs when transaction volumes were low.

However, these traditional approaches have become a structural weakness rather than a reliable foundation.

As UAE SMEs grow, their financial operations become more complex. Multiple revenue streams, higher invoice volumes, VAT obligations, and corporate tax reporting now demand a level of accuracy and speed that manual systems struggle to deliver.

What we consistently observe among growing businesses is not a lack of effort, but a lack of visibility and control.

Feature | Traditional Accounting | AI Accounting |

Data Entry | Manual | Automated |

VAT Accuracy | Error-prone | High accuracy |

Compliance Readiness | Reactive | Proactive |

Reporting Speed | Monthly | Real-time |

Audit Preparation | Stressful | Audit-ready |

Scalability | Limited | Easily scalable |

The Most Common Challenges We See in Practice

Growing SMEs across Dubai, Abu Dhabi, and the wider UAE frequently face:

VAT errors caused by manual data entry, leading to incorrect tax treatment, duplicate records, or missing documentation

Delayed financial visibility, where business owners only understand their financial position weeks after the month-end

Poor document management during audits makes it difficult to retrieve invoices, receipts, and supporting records

Difficulty tracking cash flow, especially across multiple banks, payment gateways, and operating accounts

These challenges are common not only in Dubai and Abu Dhabi but across SMEs in the wider GCC region, where multiple jurisdictions and evolving regulations demand more advanced accounting solutions

Why This Creates Compliance and Business Risk

These challenges are no longer minor operational inconveniences. Under the UAE Federal Tax Authority (FTA), businesses are expected to maintain accurate, timely, and well-organized financial records that can be produced quickly during audits or regulatory reviews.

Manual accounting systems make this expectation expensive and difficult to meet. They require additional staff time, repeated reconciliations, and constant follow-ups, increasing both operational cost and compliance exposure.

In 2024, the Federal Tax Authority conducted over 93,000 inspection visits, a 135% increase in audit activity, highlighting the importance of accurate financial processes.

What Is AI Accounting in the UAE? (Simple Explanation for SMEs)

AI accounting uses intelligent automation and machine learning to handle routine accounting tasks with greater speed, accuracy, and consistency. Its primary purpose is to reduce manual effort, improve compliance, and give business owners clearer insight into their financial operations.

Rather than replacing accountants, AI accounting removes friction from day-to-day processes while leaving oversight, judgment, and regulatory interpretation in human hands.

Modern platforms that combine AI with professional support allow businesses to process transactions continuously, generate real-time reports, and maintain accurate records without relying on spreadsheets or disconnected tools.

What AI Accounting Can Do

AI-enabled systems can:

Read invoices and receipts digitally, capturing essential data directly from source documents

Apply correct tax treatments, including VAT classifications aligned with UAE and MENA regulations

Match payments automatically across banks, invoices, and vendors

Flag inconsistencies or anomalies, such as missing documentation or unusual amounts

These capabilities help businesses across the UAE and wider MENA region maintain accuracy, improve efficiency, and reduce compliance risk.

Expert Insight: Why Human Oversight Matters

From real-world experience, the most effective approach is a hybrid model, where AI handles volume and consistency, and accountants provide judgment, compliance insight, and strategic advice.

This process ensures that financial data remains accurate and timely while being fully compliant with evolving regulations and prepared for rigorous audits.

Platforms like Timber combine automation with dedicated accountants to provide this balance, supporting businesses across the MENA region with both efficiency and trustworthiness.

How AI Accounting Improves VAT & Corporate Tax Compliance in the UAE

VAT Accuracy and Classification

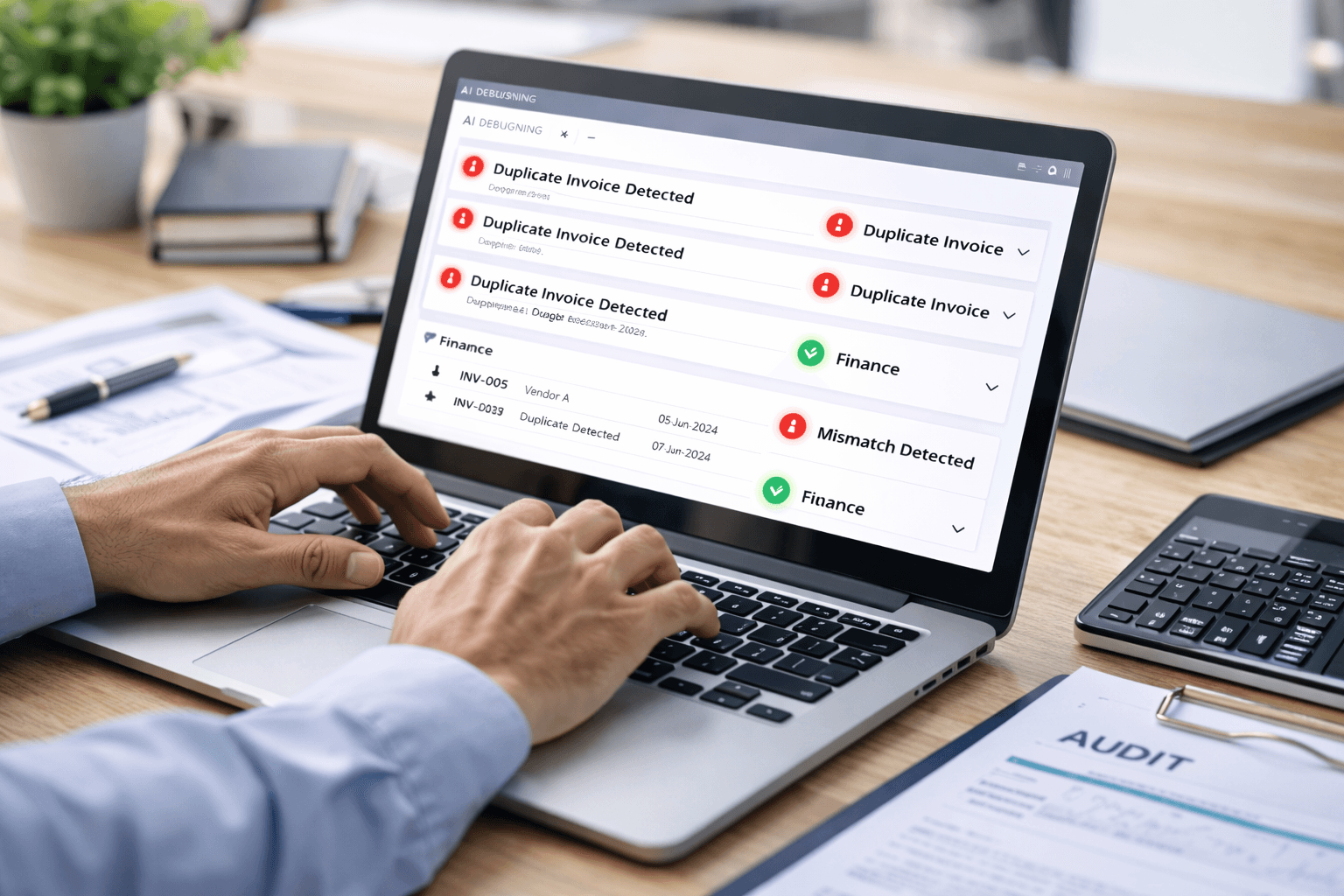

Accurate VAT reporting is one of the most common challenges for UAE SMEs. Even small errors in manual processes can trigger penalties or delays. AI accounting significantly reduces this risk by applying consistent tax codes, detecting duplicate or missing invoices, and flagging mismatches between invoices, payments, and accounting records.

These capabilities ensure that businesses maintain clean, reliable records aligned with Federal Tax Authority (FTA) requirements for accuracy, audit readiness, and compliance. In practice, this translates to:

Fewer VAT errors and penalties

Faster reconciliation of accounts

Clear documentation for audits

Corporate Tax Readiness

With UAE corporate tax now a standard requirement, businesses need structured and traceable financial data. AI-driven accounting systems help by maintaining complete audit trails, automating tax calculations and reconciliations, and generating reports that support filing and compliance reviews.

This allows management to focus on strategic decisions rather than chasing errors, while ensuring full regulatory compliance. Key benefits include:

Reliable corporate tax calculations

Easily accessible historical financial records

Reduced manual workload and operational risk

Online Accounting in Dubai, Abu Dhabi, and Across the UAE

Cloud-based accounting platforms combined with AI provide real-time visibility and compliance control for businesses operating across different emirates.

In Dubai, companies handling high transaction volumes and rapid growth can maintain control without slowing operations or overloading staff. In Abu Dhabi, businesses often face higher compliance expectations, particularly in regulated or government-linked sectors, and automation ensures reporting consistency and reduces errors during audits.

Managing Multi-Location Operations Across the UAE

For businesses operating across Sharjah, Ajman, Ras Al Khaimah, Fujairah, Umm Al Quwain, and across the UAE, AI-driven online accounting provides a single, unified view of financial health. This goes beyond remote access:

Centralized reporting allows management to monitor cash flow, expenses, and VAT obligations across all locations without reconciling multiple spreadsheets.

Standardized processes ensure that each office follows the same accounting workflows, reducing errors and audit risks.

Automated compliance checks keep track of local and federal regulations simultaneously, helping SMEs avoid penalties in multiple jurisdictions.

Real-time insights empower finance teams to make faster, data-backed decisions, whether it’s forecasting, budgeting, or assessing investment opportunities.

For businesses expanding into KSA or other GCC markets, these solutions ensure consistent compliance and centralized financial management

Common Mistakes SMEs Make When Adopting AI Accounting

Adopting AI accounting can transform financial operations, but businesses often stumble on avoidable mistakes. From real-world experience working with UAE SMEs, several common pitfalls emerge.

Treating AI as a Full Replacement for Accountants

A frequent misconception is believing AI alone can handle all accounting responsibilities. In reality, AI enhances efficiency, but human expertise remains essential for interpreting complex tax regulations, validating unusual transactions, and making strategic financial decisions.

Pairing automation with dedicated accountants ensures compliance and reliable insights, particularly during VAT filings or corporate tax audits.

Skipping Proper Setup and Integration

Jumping into AI accounting without integrating it with existing tools or workflows can cause duplicate entries, reconciliation errors, and incomplete reporting. Staff can become frustrated when processes are inconsistent.

Taking the time to connect AI accounting to ERP systems, invoicing tools, and banking platforms reduces errors and saves hours of manual work. Platforms that integrate seamlessly, like Timber, handle this smoothly.

Overlooking Regional Compliance Requirements

UAE and GCC tax frameworks evolve rapidly. Some SMEs adopt generic AI solutions that fail to account for local VAT, corporate tax, or reporting rules.

Choosing a system designed for the region, capable of handling FTA regulations and multi-emirate compliance needs, is crucial for avoiding costly mistakes.

Underestimating the Importance of Training

Even the best AI tools fail if staff don’t know how to use them properly. Misclassified transactions, ignored anomalies, or misinterpreted reports are common problems.

Ongoing training and encouraging teams to review AI-generated insights rather than blindly trusting them ensures accurate and actionable financial data.

Ignoring Data Accuracy at the Source

AI accounting relies on clean, structured data. Feeding the system with inaccurate or incomplete records will only amplify errors.

Maintaining good bookkeeping habits, validating invoices and receipts, and standardizing workflows across locations ensures reliable outcomes and maximizes the efficiency of AI-driven platforms.

Conclusion: A Smarter Accounting Model for 2026

As 2026 begins, UAE businesses face a clear choice: continue managing growing complexity manually or adopt smarter systems supported by professional expertise.

AI accounting and online accounting are not trends; they are tools. When implemented responsibly, they help businesses remain compliant, informed, and resilient in a changing regulatory environment.

The most sustainable approach is not replacing people with technology, but empowering people through technology.

Ready to Upgrade Your Accounting for 2026? Stay compliant, gain real-time visibility, and leverage AI-driven insights with Timber’s dedicated accountant. From VAT and corporate tax to automated workflows, we make finance effortless so you can focus on growing your business.

👉 Book your free consultation today: https://timber.me

Frequently Asked Questions

What is AI accounting in simple terms?

AI accounting uses software to automate routine accounting tasks while accountants handle review and compliance.

Is AI accounting suitable for small businesses in the UAE?

Yes, especially for VAT-registered SMEs seeking efficiency and accuracy.

Can AI accounting support UAE VAT and corporate tax?

Yes, when systems are configured correctly and supervised by professionals.

Is online accounting secure?

Reputable platforms use encryption and access controls aligned with international data security standards.

Simplifying accounting and tax filing for businesses

An AI-powered finance solution, supported by real accountants, to simplify your finances without the high costs or complexity of traditional accounting services.